Intro: Global Gold Prices and Central Banks

Central banks around the globe and gold prices are very much connected. The actions and policies of these major players create a ripple effect across the entire global market.

Central banks hold enormous reserves of gold as part of their economic strategies, making them highly influential when buying, selling, or policy-making. These reserves help stabilize economies but can create some tricky trends worth our attention.

Gold Rush is happy to watch these trends for you! If you are interested in selling gold in Sugar Land Houston, any other precious metal, or diamonds - Gold Rush is here for you. Please enjoy this article outlining the role of central banks in gold prices, with historical trends outlined as well as future predictions.

Key Takeaways

- Reserve Management: Central banks significantly influence gold prices through their reserve management.

- Economic Uncertainty: Increased gold buying by central banks often correlates with economic uncertainties.

- Major Players: Policies from major banks like the Federal Reserve and the European Central Bank are pivotal.

- Consistent Growth: Central bank gold buying trends have consistently grown over recent years.

- Predicting Prices: Understanding these trends helps investors and analysts predict future gold prices.

How Central Banks Influence Gold Prices

Monetary Policy and Interest Rates

Central banks use several mechanisms to impact gold prices, and their monetary policies and actions directly influence the market.

Monetary policy, particularly interest rate decisions, directly impacts gold prices. Central banks adjust interest rates to manage inflation and economic growth, indirectly affecting gold's appeal.

High Interest Rates typically reduce gold's appeal as an investment due to better returns from interest-bearing assets. Investors are more inclined to choose yield-bearing investments when interest rates are high.

Conversely, Low Interest Rates increase gold's attractiveness because of the low opportunity cost of holding non-yielding assets like gold.

Recent Policy Impacts from Major Central Banks

Federal Reserve: The Fed's hawkish monetary policy in recent years has put pressure on gold prices, reducing investor demand for gold as interest rates rise.

Its interest rate hikes aimed at combating inflation made other assets more attractive compared to gold.

European Central Bank (ECB): The ECB's expansionary monetary policy and negative interest rates increased demand for gold in Europe as a safe haven.

The ECB's move to keep rates low to stimulate growth boosted gold's appeal as a reliable store of value.

People's Bank of China (PBoC): China's interest rate reductions and monetary easing have contributed to higher regional gold demand.

The PBoC's policy of lowering interest rates to stimulate economic growth has made gold a more attractive option for investors seeking a hedge against inflation and currency devaluation.

Reserve Management Strategies

Central banks use reserve management strategies to safeguard their economies, stabilizing their currencies and hedging against uncertainties. The way central banks manage their gold reserves can influence global gold prices.

- Diversification: Central banks diversify their foreign reserves by holding gold alongside other assets like U.S. Treasuries.

- Strategic Buying: Some central banks, like the People's Bank of China and the Central Bank of Russia, strategically increase their gold holdings during economic uncertainty.

- Active Selling: Others, like the Central Bank of Kazakhstan, actively manage their gold reserves through periodic selling.

- Market Timing: Timing purchases and sales to benefit from market conditions.

Strategies Employed by Top Central Banks:

- People's Bank of China (PBoC): Increased gold reserves by 225 tonnes in 2023, reflecting strategic buying amid geopolitical uncertainties.

- Central Bank of Russia: Resumed gold buying in 2022 to bolster its reserves amid international sanctions.

- European Central Bank (ECB): Regularly purchases and sells gold to diversify its foreign reserves.

- Federal Reserve: Holds the largest gold reserves globally but does not actively trade its gold reserves.

Global Trends in Central Bank Gold Purchases

Central bank gold purchases have surged in recent years, primarily driven by geopolitical uncertainties and economic instability. Understanding these trends helps to provide a clearer picture of future market directions.

Recent Buying Spurts and Their Triggers

Recent years have seen unprecedented buying sprees from central banks.

The following table highlights the significant increase in gold reserves among key central banks over the last decade and the triggers behind these purchases.

Table: Recent Central Bank Gold Purchases and Triggers

|

Country |

2013 Reserves (Tonnes) |

2023 Reserves |

Key Triggers |

|

China |

1,054 |

2,235 |

Geopolitical tensions, diversification |

|

Russia |

1,035 |

2,299 |

International sanctions, inflation hedge |

|

India |

557 |

787 |

Currency stability, economic growth |

|

Turkey |

441 |

540 |

Inflation control, local gold demand |

|

Poland |

103 |

359 |

Economic uncertainty, diversification |

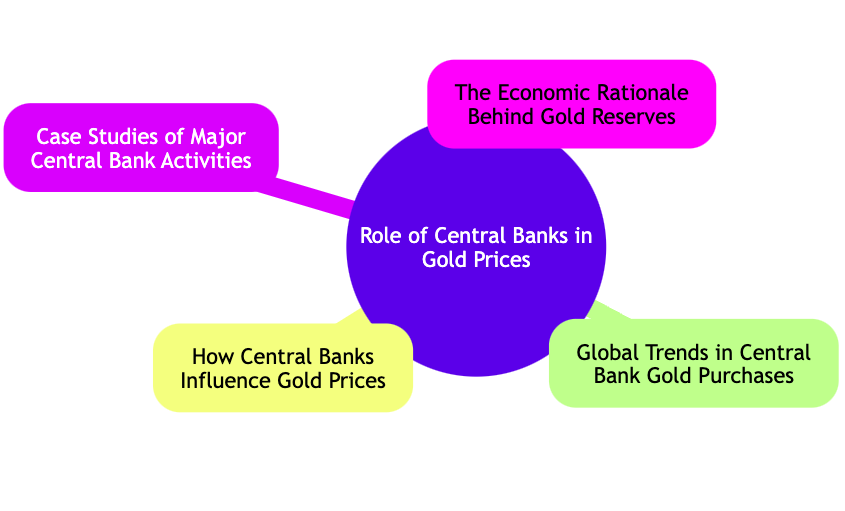

Visual: Historical Long-term Trends and Predictions

Case Studies of Major Central Bank Activities

Several major central banks have significantly impacted global gold prices through their policies and reserve management strategies.

The Federal Reserve and Gold

The Federal Reserve's monetary policies have long influenced the gold market due to the dollar's global dominance.

- Interest Rate Policies: Aggressive rate hikes have historically driven down gold prices by making other assets more attractive.

- Quantitative Easing (QE): Expansionary monetary policy and QE programs have boosted gold demand as an inflation hedge.

- Gold Standard Legacy: Despite not actively trading gold, the Federal Reserve maintains one of the largest gold reserves globally.

Key Actions and Their Impacts:

- 2013 Taper Tantrum: Gold prices fell sharply as the Fed signaled a slowdown in QE.

- 2020 COVID-19 Response: Gold prices soared as the Fed cut rates and expanded QE programs.

- 2022 Interest Rate Hikes: Hawkish monetary policy put downward pressure on gold prices.

Emerging Markets and Their Influence

Emerging market central banks have increasingly influenced gold prices through their aggressive buying strategies.

China and India

- China: The People's Bank of China (PBoC) increased gold reserves to over 2,200 tonnes by 2023, reflecting its strategy of reducing reliance on the U.S. dollar.

- India: The Reserve Bank of India added nearly 230 tonnes over the past decade to stabilize its currency.

These activities by emerging market central banks indicate a long-term strategic shift towards gold as a key reserve asset, further influencing global gold prices.

The Economic Rationale Behind Gold Reserves

Central banks hold gold reserves for various reasons, with economic stability and inflation hedging at the forefront.

Gold provides financial security because it remains a reliable store of value during economic downturns and geopolitical uncertainties. Unlike fiat currencies, whose value can erode due to inflation and monetary policy shifts, gold maintains its purchasing power over time.

Gold also serves as a diversification tool for central banks.

Central banks can reduce their overall portfolio risk by holding gold alongside other reserve assets like foreign currencies and government bonds.

In times of financial crises, when currencies and other assets may depreciate, gold usually retains or increases its value. This stability makes it essential to central banks' broader economic strategies.

Wrapping up: Watching Gold Price Trends with an Expert Eye

Central banks are pivotal in shaping the global gold market through their monetary policies, reserve management strategies, and gold purchasing trends. Their actions significantly impact gold prices and influence the behavior of institutional and individual investors alike. Understanding their motivations and strategies provides valuable insights into future gold price trends.

Gold Rush is a reliable partner in monitoring these market dynamics.

With expertise in the precious metals industry and a keen understanding of global economic trends, Gold Rush offers accurate assessments and tailored solutions for selling gold in Sugar Land Houston. By partnering with Gold Rush, you can access valuable insights and trusted expertise in this dynamic market.